Elevate Your Financial Experience With Lending Institution

Credit rating unions, with their emphasis on member-centric solutions and area participation, present an engaging option to standard banking. By focusing on individual demands and promoting a sense of belonging within their membership base, credit unions have actually carved out a niche that reverberates with those seeking a much more personalized strategy to handling their financial resources.

Benefits of Lending Institution

Another advantage of credit report unions is their democratic framework, where each participant has an equivalent vote in choosing the board of directors. This makes sure that decisions are made with the finest passions of the participants in mind, instead of focusing entirely on making the most of earnings. Moreover, cooperative credit union commonly offer economic education and learning and therapy to assist members enhance their economic literacy and make informed decisions concerning their money. In general, the member-focused method of credit rating unions sets them apart as institutions that focus on the health of their area.

Subscription Demands

Some credit unions may serve individuals who work or live in a certain geographic area, while others might be affiliated with particular firms, unions, or associations. Additionally, household participants of present credit history union members are commonly eligible to join as well.

To become a participant of a cooperative credit union, individuals are usually needed to open an account and preserve a minimal deposit as specified by the establishment. In many cases, there might be one-time subscription costs or ongoing membership fees. As soon as the subscription requirements are satisfied, people can delight in the advantages of belonging to a cooperative credit union, consisting of access to customized economic services, competitive passion prices, and an emphasis on participant complete satisfaction.

Personalized Financial Solutions

Personalized financial services tailored to private needs and preferences are a characteristic of lending institution' dedication to member complete satisfaction. Unlike standard banks that commonly offer one-size-fits-all options, credit report unions take a more customized method to handling their members' finances. By recognizing the one-of-a-kind goals and scenarios of each participant, credit score unions can provide customized recommendations on cost savings, financial investments, financings, and other financial items.

:max_bytes(150000):strip_icc()/dotdash-credit-unions-vs-banks-4590218-v2-70e5fa7049df4b8992ea4e0513e671ff.jpg)

In addition, cooperative credit union commonly use lower costs and affordable rates of interest on financings and cost savings accounts, even more improving the individualized monetary solutions they offer. By focusing on private requirements and supplying customized services, cooperative credit union establish themselves apart as trusted monetary partners devoted to helping participants prosper monetarily.

Area Participation and Assistance

Area engagement is a cornerstone of lending institution' objective, mirroring their dedication to supporting regional efforts and important site promoting purposeful links. Credit scores unions actively take part in neighborhood occasions, enroller regional charities, and arrange monetary literacy programs to inform non-members and participants alike. By investing in the areas they serve, lending institution not just reinforce their partnerships however also add to the total well-being of society.

Supporting small companies is one more way cooperative credit union demonstrate their explanation commitment to regional communities. Through providing bank loan and economic guidance, cooperative credit union help business owners prosper and stimulate financial development in the location. This support goes beyond just financial aid; lending institution often provide mentorship and networking chances to aid local business are successful.

In addition, credit unions often involve in volunteer work, encouraging their employees and participants to offer back through various social work activities - Federal Credit Union. Whether it's joining regional clean-up occasions or organizing food drives, lending institution play an active role in improving the quality of life for those in demand. By prioritizing area participation and support, cooperative credit union absolutely embody the spirit of teamwork and mutual help

Electronic Banking and Mobile Apps

Credit unions are at the forefront of this electronic improvement, using participants practical and safe and secure methods to handle their financial resources anytime, anywhere. On-line financial solutions offered by credit history unions make it possible for members to inspect account balances, transfer funds, pay expenses, and watch purchase history with simply a few clicks.

Mobile apps used by credit report unions better boost the banking experience by supplying additional adaptability and access. Overall, credit history unions' on the internet financial and mobile apps encourage members to handle their financial resources successfully and safely in today's fast-paced electronic world.

Final Thought

In final thought, credit unions offer a distinct banking experience that prioritizes neighborhood involvement, individualized service, and participant contentment. With lower fees, competitive rate of interest rates, and tailored financial services, credit rating unions provide to individual needs and advertise financial wellness.

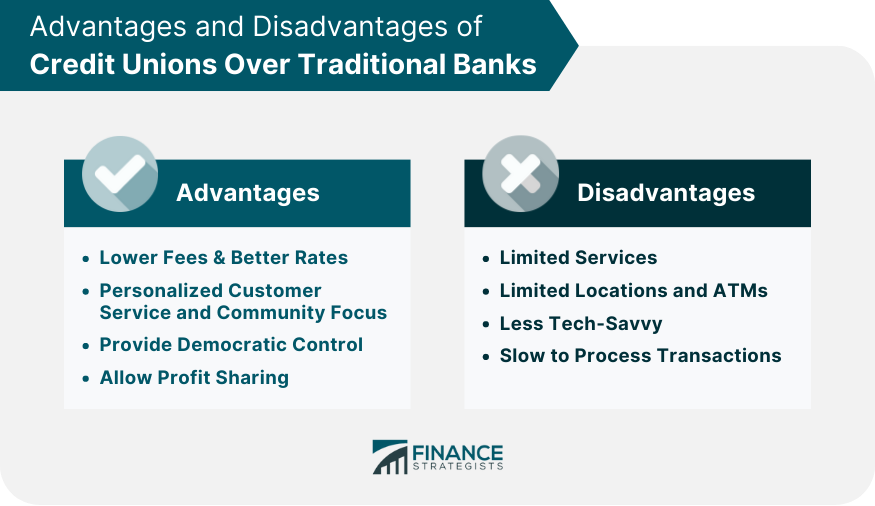

Unlike financial institutions, credit unions are not-for-profit companies owned by their members, which usually leads to decrease charges and much better interest rates on cost savings accounts, finances, and credit scores cards. Furthermore, debt unions are understood for Website their personalized client service, with staff members taking the time to comprehend the unique economic goals and difficulties of each member.

Credit scores unions usually provide monetary education and counseling to aid members improve their monetary literacy and make educated decisions concerning their money. Some credit history unions might offer people who function or live in a specific geographical area, while others may be affiliated with particular business, unions, or associations. In addition, household participants of current credit report union members are usually qualified to sign up with as well.